Small Town "Problems"

County Commission Tuesday where they will discuss the road presentation and sales tax referendum. I will be there as per usual.

But today, I want to go back to the West side and talk small town politics and "problems" of being in a small town where everyone knows everyone. This time, banking services.

I am going to preface this article with this statement:

As with most everything I have done with this page, I am showing people what is going on, pulling back the curtain so to speak. I am pointing out process issues, expired contracts and things of that nature... things that people may not know if no one was looking at it. I am simply sharing what I am finding. I do not have a personal agenda against anyone or anything like that. I understand people have made mistakes and may have missed something here or there.. I make plenty of them myself, but mistakes are the greatest teaching tools. I have learned far more from my mistakes than anything else.

But that does not mean those mistakes should not be talked about or discussed, particularly when it regards government entities and elected officials, as they are under a bit more scrutiny.

That being said...

Something did not sit right with me after the October 13th and October 27th meetings. During those meetings, Mayor Joe Meek brought up the city's banking contract with Seacoast Bank. He mentioned a desire to revisit the banking contract and see if there is a better deal out there.

Ok cool. So what is the problem?

Well it is what was said and how the whole thing played out.

It is normal for government officials to want to review contracts, but why so suddenly. The first time I can see this mentioned was the October 13th meeting. Meek asked for it to be on the agenda out of the blue.

He said that it has been 5 years since the contract was last bid and he would like to go out and look at options. But then he said:

"I want to be candid. A lot of other government jurisdictions have recently gone with one I am fond of... Brannen Bank. The City of Inverness, the Tax Collector, the Sheriff's Office, the School Board... all recently switched".

This sounded like he wanted to switch to Brannen right then and there since others have done it recently and because he is fond of them.

The council ends up asking staff to avoid going through a detailed process, but to bring back some comparisons at the next meeting.

Umm.. last I checked, I do not think governments normally just ask and compare products.. That is what the RFP process is for, but the council wants to avoid that apparently.

At the next meeting on October 27th, staff comes back with what was requested of them.

Staff said that they asked Seacoast Bank and Brannen bank to provide numbers for various things so that staff can compare them. Staff said that Brannen provided a better option and that if Council preferred to skip the RFP process, they could piggyback off one of the other entity's contracts.

As the Council took the discussion, I was again blown away with comments made by Council members.

Meek said the following during this meeting:

"I am biased towards Brannen Bank. They are the only county bank and have a long history here."

"Id like to see up pursue that option (Brannen)."

Regarding the RFP Process:

"That is a process in and of itself. I am normally in favor of that process, but we have two good options in front of us and I would like to see us go with the local institution."

"I'd like to see us bring back the piggyback agreement."

Council member Chris Ensing agreed:

"I bank with Brannen too and I would like to see it come to them"

Umm... did I just hear what I think I heard. Two elected officials admitting they are biased towards one service provider for something that generally goes through a RFP process?

On top of that, they desire to do the piggyback option with the school board because it allows them to hand pick Brannen and not do the RFP process.

The others also agreed that Brannen had the best offer based on what was presented to them.. again.. without RFP process.

At the November 10th meeting, the City Attorney cautioned them on that piggyback idea saying that the school board contract expires in 2027, which is when this contract would expire if they switched since it is tied to the School Board.

He also said a switch will take awhile because some accounts need to remain open for up to a year, so the transition will take some time and that 2027 expiration may be an issue. He also said that the RFP may be the best option and he can bring that back at the December meeting.

Meek said:

"I would like to bring it back (school board piggyback).. That is my stance on it."

So it looks like the piggyback route is the way they want to go.

Now, to be clear, I am questioning the process, not that Brannen Bank offers the best terms. Maybe they do and that is the best option for the city. All good. But for me, as with all things I do here.. do it the proper way and avoid optics issues. People want to trust government... this is how you gain the trust.

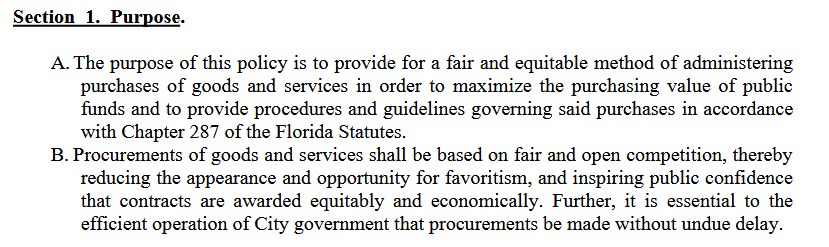

They are admitting bias towards one institution. That is expressly against the City's Purchasing Terms.

This violates the very first section of the City's Purchasing guidelines. Being biased certainly doesn't provide a fair and equitable method of purchasing now does it?

That is how you lose trust, even if the end result is better for the entity and tax payers.

Now granted, the piggyback option is a viable way to procure services... however, it largely bypasses the public process most governments use to avoid these types of issues and ensure they are getting the best services possible.

This was the issue that I had with the Inspire Contract for the Comprehensive Plan update. They are hand picking companies they like for whatever reason and doing it in a way to avoid the RFP process, which may not show their favored company as being the best option.

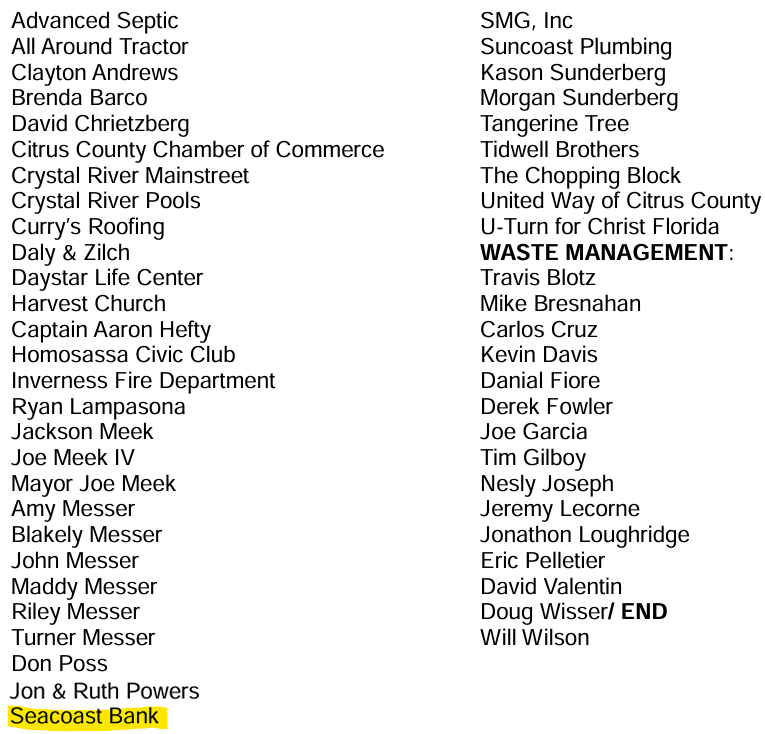

And what does Seacoast think of all this? Afterall, they presented a check to the city in April for $4,000 to be used towards city events. They were recognized as a Hurricane Hero for the city back in March for their work during the hurricanes last year, along with several other companies and individuals. The city acknowledged they were a great partner.

They are now sitting here watching officials say they are biased towards another company, while still having a contract with the city? Awkward.

Staff went to each bank and asked for their numbers for various comparisons. But it was NOT a formal bidding process. Who is to say that the terms will not be more favorable if it is competitively bid out? Maybe Seacoast now knows they may lose the contract and comes back with a better deal for the city if it is bid out through a RFP. Or maybe they do not. But you do not know the options until you do the process.

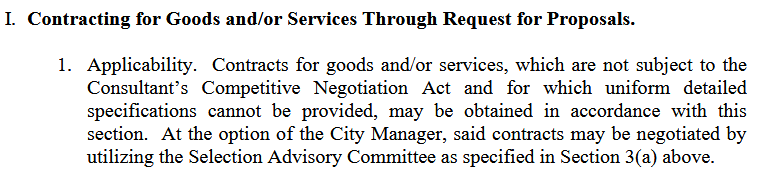

Now, the city may not be obligated as far as I can tell to do the RFP process for banking services. I do not think it hits the $50k spending threshold to require it in the city's purchasing guideline.

There is a section that allows services like banking to go through a RFP process at the request of the City Manager, but I believe that is optional. Perhaps the city manager should step in and ask for the RFP. Take it out of the hands of the council... but she is walking on thin ice due to the evaluation issue, so perhaps not the best time to flex her muscles so to speak, but the ability exists.

This is the process they undertook in 2019 when they did the RFP process and awarded the contract to then Drummond Bank (later Seacoast). That contract was for 3 years, with additional 3 year terms available at the Council's direction.

I assume the city extended it by 3 years in 2023, although, they did start another RFP process in 2023, but abandoned it for some unknown reason. That puts us to August 2026 and likely the reason Meek brought it up.

Ok. So still... What is the big deal.

It is in the "I am biased" comment and further discussion of how they would prefer to use Brannen. This all goes against the city's own purchasing guidelines that want open and fair procurement processes to specifically avoid bias.

But now I am curious. Why is Meek biased towards Brannen Bank?

For those that don't know, Joe Meek and his wife own a couple different companies. A construction company that builds homes being one. A realty office being another. Absolutely nothing wrong with any of that. Most elected officials have some other type of employment. Perfectly normal.

Got it.

Well, construction companies need capital to build the homes they will sell to clients, right? Most have a bank or several banks they work with.

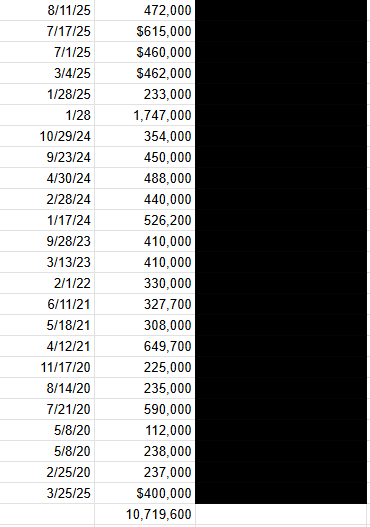

Well one thing about mortgages is that they are public record. I took a bit of time (about 5 hours) over the weekend to dive into the public records. I found that the Meeks had received $10,719,600 over 23 construction mortgages or equity lines from Brannen bank since 2020.

Here is the list I put together. I redacted the addresses.

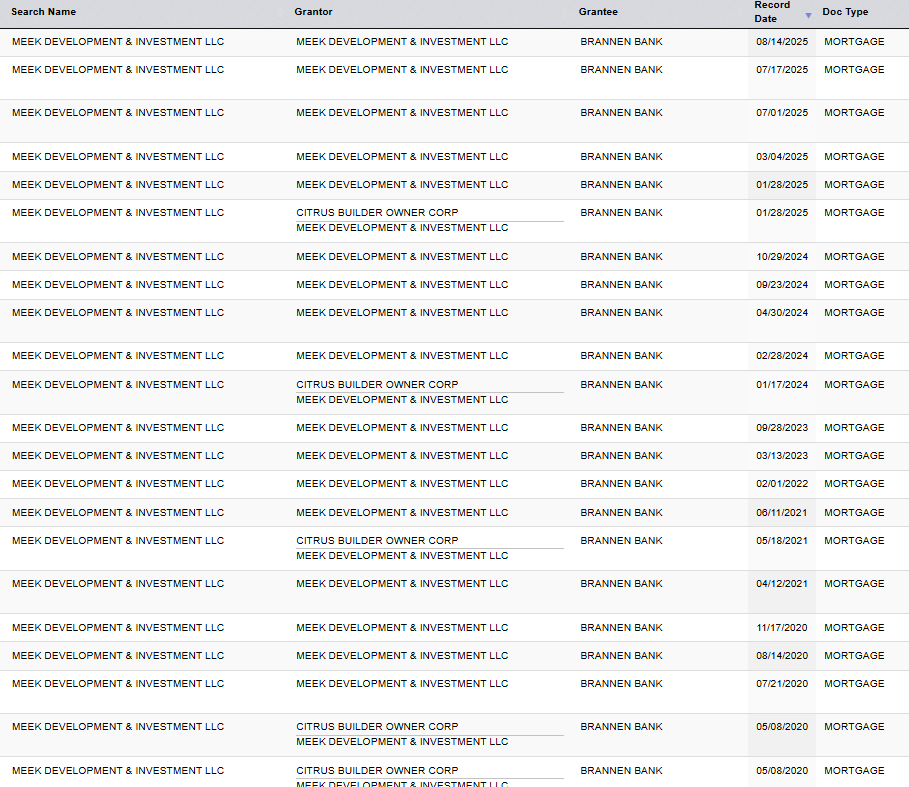

Here is the screenshot showing the clerk's website with the same information.

They have borrowed no other money from any other bank in Citrus County during this period that I could find. They may have used other banks if they built in other cities, but nothing in Citrus County aside from Brannen from what I can see.

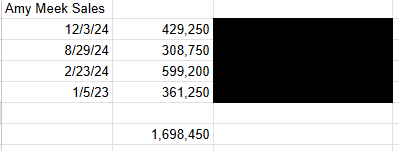

Further, Amy has helped at least 4 clients buy a home here locally with Brannen as the lender for the purchase for a total of $1,698,450.

Again, addresses redacted.

That is a total of $12,417,450 that has funneled through the Meeks to Brannen Bank over the last 5 years.

Yeah, I can see why he is biased. He loves them and they love him. I can't fault him for being a successful business owner and having a banking partner like Brannen.

So again, nothing illegal or anything like that. This is the normal course of business, but certainly, the optics of wanting to bypass the RFP process to award Brannen looks a lot different when you consider the above.

Before everyone comes here and says "He needs to not vote on this matter when its time"... It is more complicated than that.

Without getting too technical, elected officials on boards cannot simply decide not to vote on something because it looks bad or might be perceived as a conflict of interest. They are required by law to make every vote that they are in person for, unless there is legitimate conflict defined by law.. Generally, this is mostly regarding votes that would give profit/loss to themselves, a company they own or immediate family. There are other exceptions, but most people abstain for this reason.

One of them is if it will contribute to the profit/loss of a "business associate of the public officer". That is covered in 112.3143(2c)

Can it be argued that Brannen Bank is a business associate of the Meeks, as their financing company essentially? Eh.. Not a lawyer, but probably a stretch there. Unless the bank is making certain decisions within the business, I can't see how normal banking activities would cause them to be viewed as a business associate.

I will say that there likely is not a conflict that would require him to abstain from voting on Brannen Bank getting the banking contract with the city... but I can certainly agree that it does not look good for the optics and for a transparent procurement process free of bias.

To be clear in case it wasn't... this is about the optics... not suggesting any wrong doing or anything like that.

We will see at the next meeting what the council decides to do. I would think the best option to avoid these optics issues is to go through the RFP process as they have done previously... and then use that to decide the best option for the city in a public manner. See what the offers are, rank the firms and let the citizens see the transparent process play out.

Who knows, maybe Seacoast or other banks come back and beat the Brannen offer, not that they have seen it informally through this process... or maybe they do not and Brannen is the best... at least it followed the process that everyone can see.

Plus, this will avoid the 2027 contract issue that the piggyback will present because if the School Board cancels for whatever reason, the city will need to cancel as well... and then back to square one.