Impact Fee is Back

Browsing through the agenda for the meeting on Tuesday, something caught my eye. The Impact Fees are back on the agenda. This item is to set future workshops.

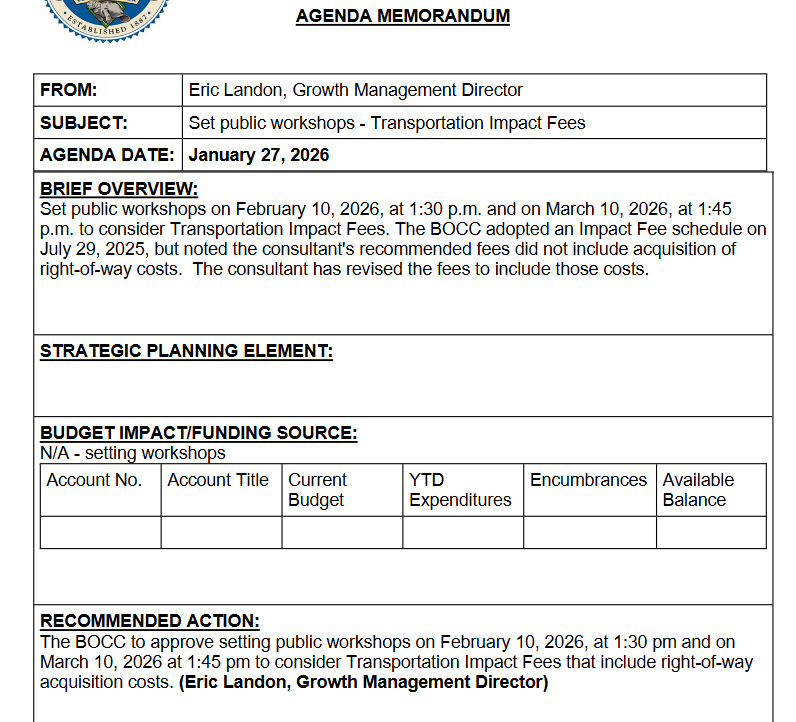

This is under consent agenda, so do not expect too much discussion. The idea here is that they want to bring back impact fees for a review because when they raised them back in July of 2025, they did not have the right of way acquisition costs factored into the fees.

The consultant did not include those because it was not asked of them by staff.. Ooof.

Now that they are done, the commissioners want to talk about them.

But I have a question.

Is this even allowed?

You see, the state has laws surrounding how often impact fees can be increased. Among them is:

- An impact fee can only be raised once every four years

- They cannot be raised more than 50% of the current rate

- Impact fees are to be phased in.

And so on.

There is also an exemption to this if counties desire to increase them faster/higher than state law allows.

In order to do this, the county must show a demonstrated need study that

"justifies these increases that was done within the last 12 months and that expressly demonstrates the extraordinary circumstance necessitating the need to exceed the phase in limitations." FS 163.31801(5)(g)(1)

The county hired a consultant to provide this study for us and presented it to the board in July 2025.

The board voted then to raise the impact fees to 100%, which increased them by about 65% based on this study. Single family home impact fees went from $7,949 to $13,109 after this change.

Aside from builders and those in that type of industry, you will be hard pressed to find pushback from a large number of people about this raise. Everyone largely agrees it was needed to address the road infrastructure and expansion projects like 491 that are desperately needed.

Remember, Impact Fees cannot be used for resurfacing.

There was a wrinkle in this plan that appeared during the meeting. Commissioner Barek asked about right of way acquisition and if those numbers were included. As mentioned, they were not. She then asked why the board was wanting to push this through without the ROW being included as that is the biggest expense in expansion projects.

The other commissioners largely said they did not want to delay the vote any longer because it had already been noticed and would be unfair to people who were prepared to speak about it. If they wanted to add ROW, they could bring it back in January.

Here we are.

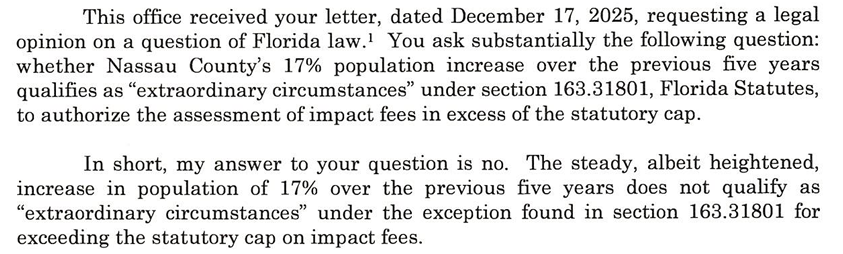

But remember... state law. We need an "extraordinary circumstance" to increase impact fees faster than 4 years. The new fees took effect in October. It has been 3 months. What is the extraordinary circumstance to do it again?

There is none. This was failure to add it to the last study. That is a mistake, not an extraordinary circumstance. They are going to try to tie it to the previous study. But will the state accept that? They have to approve the increases. It is entirely possible that they look at this and say "Why did you not do this before?" and then deny us the ability to do it again, barring a new study showing a new extraordinary circumstance.

Also, consider that our study showed growth as the main driver of this.

"Our findings show that the County’s impact fee program, at its current state, under-collects the cost of the expanding EMS, Fire, Law Enforcement, Libraries, Parks & Recreation, Public Buildings, Schools and Transportation services to meet the demands of growth"

Makes sense, right? More growth means more need for expansion which means more costs and that means we need more fees.

However, the Attorney General of Florida issued an opinion recently against Nassau County who was trying to raise impact fees using growth as the reason.

Our study states our growth rate since 2021 was 10.8%.

Further... the attorney general's opinion states that the Florida Statutes already account for new growth.

"Remember also that Section 163.31801(6), Florida Statutes, already permits local governments to raise rates due to new development and growth. Indeed, impact fees exist for that very purpose—to aid local communities as they adjust to “new growth.” Local governing authorities accordingly may raise impact fees up to 50% every four years without any special justification."

He goes on.

"Put differently, the same growth that justifies limited, regimented impact fee increases in the statute can’t also justify extraordinary increases that jettison those strictures associated with those limited, regimented impact fee increases."

And the final nail in the coffin.

"Impact fees are not taxes. We caution that the implementation of the increases by Nassau County of almost 100% of the current rate” without the requisite justification appears to be a tax disguised as an impact fee."

According to the attorney general, we cannot increase impact fees due to new growth.. Period.

Now... this is the attorney general's opinion and is not binding. Courts would have final say in the matter via litigation... but he is the state's top lawyer and law enforcement officer.

The county's study also indicated that housing permits were on the rise (also growth), that construction costs were increasing due to inflation and that projects are coming in well above "budgeted" costs... Stating that these also provide "extraordinary circumstances".

I do not see an attorney general's opinion discussing the inflation aspect that the consultant has mentioned. Maybe that is an extraordinary circumstance... but I do not think inflation in Citrus is much different than inflation across Florida. Does that allow ALL counties to increase impact fees citing inflation? Not so sure.

In any case, to my knowledge, no on has questioned it at the state level and no one has challenged it either.... yet

But, now we want to increase them AGAIN because we failed to include ROW... when we could have done it before?

Help me make sense of that.... and what will the state say to that request? Will someone locally challenge this new increase, if they vote for it?

Again, we had the chance to postpone the previous vote and wait until the study was updated to include ROW. The consultant said they could do it before the October 1st deadline.

Why was that important? Because the state laws changed on October 1st in regards to the total number of votes needed to pass an impact fee increase.

Prior to Oct 1, simply majority was needed. In our case, that is 3 out of the 5 needing to approve any increase... just like any other vote.

Starting Oct 1, that increase to UNANIMOUS vote needed to pass an impact fee increase. Yeah, good luck with that.

Accounting for the ROW, the transportation impact fee for a single family home would go from $5,193 to $9,374. For a commercial building it would go from $5,257 to $9,489 per 1000 sqft.

To put that in perspective, had Target built in November 2025, they would have paid around $694,000 in transportation impact fees. If the BOCC approves the change and increase, they would pay $1,252,548 in transportation impact fees.

They built before the recent increases, so I have no idea what they actually paid, but significantly less than those numbers, but this gives you a real world idea on what this looks like.

Going to be interesting discussions in February and March.