Affordable Housing Need

To kick off this Wednesday, we are going to put our thinking caps on. Yes.. we are going to think on a Wednesday... in the middle of the week... oh the horrors!

As we are going through this comprehensive plan process (and prior to it), I have heard a lot of talk about affordable housing and the dire need we have in Citrus County.

This is perhaps one of the most important conversations we can have. How do we make homes cheaper for those in our community?

It is a good question and one we have not seen an answer to yet... but it requires a discussion.

One one hand, we have those who do not want to see an influx of rental options because they feel it will hurt their home values... or bring the "riff raff".. the typical stereotypes you see and hear all the time. While some of that may be true (certainly some renters do not care for other people's property), I think that is the exception, not the norm.

One the other, we have people in desperate need for a place to live that cannot afford $1500 a month.

And yes.. before we get too far.. Economic growth can certainly help address these issues.. and we will talk about that here soon... but even with a booming economy, we would still have affordable housing needs.

Here is the thing. Simple economics says that supply and demand is the answer. If we have more supply than demand, prices will come down. If we have more demand than supply, prices go up. Simple right?

That is true to an extent. If everyone tried to sell their home tomorrow, prices would plummet. But at some point, the market stabilizes and then prices go up again. That is how the housing market works. Slowdowns come and go. Values go up and down. Long term trends show upward growth in values, not declines, unless a community is abandoned.

Today, there are over 400 homes in Citrus County for sale under $200k. That is a lot more inventory than we have seen over the past few years. It appears prices will come down a bit as the market slows. However, lowering interest rates may boost demand a bit, so the relief may be temporary... but, unknowns about the economy linger. Maybe it is a prolonged downcycle like 2009-2014/2015. Maybe it is a slight pullback before it ramps up again. Who knows.. Regardless, there will still be a need for affordable housing options, whether now or in the future.

But none of this helps the 18-19 year olds getting out of high school that want to do something other than college. Those entering the workforce certainly do not have the income for a bank to justify a loan... unless the bank wants to see 2008/2009 all over again.

So they cannot get loans for homes, which means, aside from living with parents/relatives, they have to rent.

Mini rant.... Can we end this myth that renting is a bad option. I know millionaires that do not own homes because they are too costly to maintain and their money is better served elsewhere. There are positives and negatives to home ownership and many times, it makes more sense to rent. Nothing wrong with renting, so perhaps we need to stop looking at it as a negative thing. Not everyone wants to be a homeowner and that is fine.

End rant.

When looking at rentals, I see a total of 11 rentals in Citrus under $1000 per month. Expand it out to $1500 per month and we see 136 rentals.

Great right.. seems like a fair amount of options.

But...

Income.

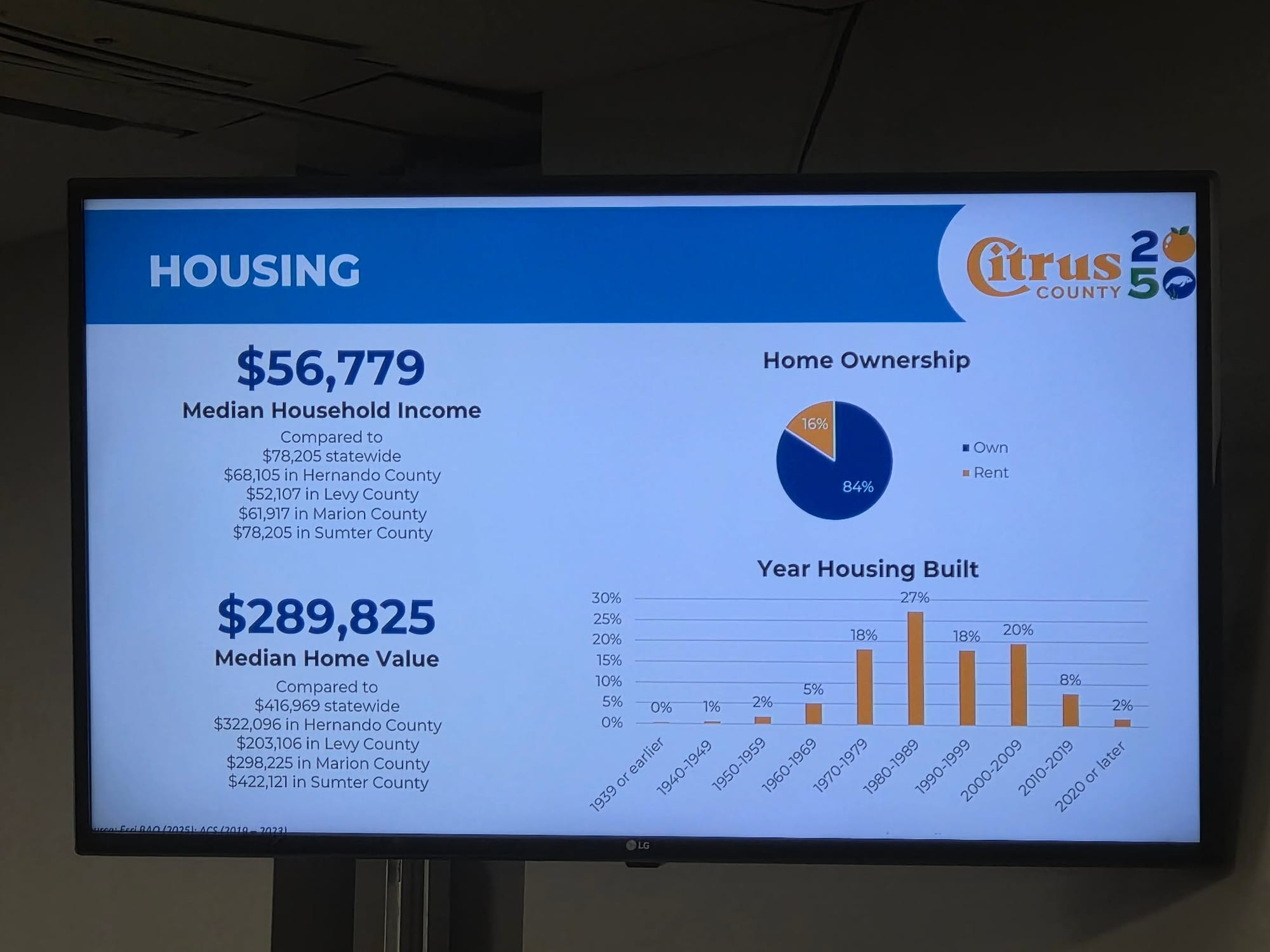

This is the slide from the Inspire workshop last week.

It shows the median household income is $56,779. That is NOT the average income. Median means that it is the middle. So 50% of the household population has income above this number and 50% below this number.

And remember, this is HOUSEHOLD, not per capita. This is everyone in the ENTIRE home making a combined $56,779.

Citrus has approximately 69,701 household. This means that approximately 34,850 households make more than $56,779 and 34,850 households make less.

If we go based on most financial advice, people should not spend more than 30% of their total income (before taxes) on housing costs. With a median income of $56,779, that 30% would be $1,419.48 monthly.

This means that those 34,850 households making less than $56,779 should not be paying more than $1419.48 per month.

Yet, only around available 136 options to choose from.

One single year of high school graduates here will see around 900 students graduate. I do not know the exact numbers, but statistics suggest that 30% of students go to college. That means 270 will leave to go to college while the other 630 do not.

Where are those 630 going to live?

Even if the numbers are off and it is only 300 or so that would stay and need housing, that is 300 EVERY YEAR competing for a limited number of housing options.

Not only that, but most of these rentals require an application fee to cover the credit/background checks... then first and last month's rental fee and a security deposit, often equal to one month's rental.

A $1500 a month home requires over $4500 up front to move into. How is someone coming out of high school supposed to come up with that and where are they supposed to live if they do not have family/friends they can rely on?

And what about people who due to various circumstances cannot buy a home? They too need rental options. Again, this community has over 34,000 households making less than the median income of $56k a year, which should be only $1400-ish per month for housing.

I don't recall the exact number, but it is around 70% of school students qualify for free or reduced lunch. We have a very large percentage of our population that are struggling with few options for housing.

So how do we get more affordable housing options?

I spoke with a commissioner a few months ago about the comp plan. Their thinking was that we needed more mixed use development. That would be the future of this county. Basically communities built around commercial hubs that include a mix of housing options. They felt density was the answer to the affordable housing problem.

The idea is that more houses provide more options which lowers the housing costs. Supply and demand as we talked about earlier.

However, I pushed back on that notion. I asked for them to show me a single community in the state that is mixed use that has actually reduced the cost of living.

Crickets.

If you know of one, please share, but when I look around the state at mixed use developments, they all have increased the costs of housing. Look at Wesley Chapel. The Villages. Dunedin.

While those communities may be "thriving", the housing costs are skyrocketing. Dunedin for instance has 16 options for rent under $1500 per month out of 126 total listings.

Now perhaps it can be argued that these communities increase the number of jobs and offer higher paying jobs as a result, boosting incomes.

The median income in Dunedin is $68,000. Wesley Chapel is $108,000. Certainly higher than Citrus County.

But what we are seeing in Citrus is not an influx of higher paying jobs with these developments. Most of them are retail/restaurant type jobs.

I also pushed back on the idea that density reduces prices. In theory, this is true... if all the homes came online at the same time. But that doesn't help the bottom line for the developers. They want to maximize their profits, right, so they wont build entire 4,000 home developments at one time. They build them in phases... 200 here.. 200 there.. and so on.

It takes YEARS to build out all the homes they got approved for, if they even build them all. Most developers do not build them all out. Take the Tuscany project for instance. That has been carved out for 5,000+ homes for DECADES and never build out. Maybe Tuscany never gets built out either... and even if they do, it won't happen tomorrow.

The build for the market to maximize profits. Makes sense. But that does not help reduce housing costs.

Apartments do... and we need more of those options here. The problem is they are costly to build and reduce the return on investment for the developer. I forgot what one of them told me a few weeks ago, but it was significantly more costly per door for an apartment complex than for a house.... which is why they need to add a commercial element to it... as commercial is significantly cheaper to build than a house. It offsets it.

But then it creates a mixed use development, which many people here do not want to see because that looks more like a city than rural areas. Then you hear them at the BOCC meeting asking not to approve that project.

But then you have what I mentioned before... mixed use areas do not reduce housing costs that I have found because the amenities increase demand for those housing developments.

The question becomes... how can we increase the options for affordable housing without necessarily increasing the housing costs as a result?

Perhaps the county can offer development credits to developers to help reduce the costs of things like apartments. If it can reduce how much the developer pays to build it, maybe it will help increase profits for the developers to lead them to want to build them as standalone projects.

Yes, economic growth will certainly help. If we can boost incomes higher, what is considered affordable also increases. 100% behind that as well, but more retail options are not going to do that... and that is largely what the growth here has led to.

As part of this Comprehensive Plan update as well as the Strategic Plan meeting in January, I hope to see some discussion on how we can create more affordable housing in this area and the plan to balance that with keeping Citrus the gem that it is.