Where Did The Gas Tax Money Go?

I have been hearing citizens question the need for the sales tax by stating something along the lines of:

"We have a gas tax, where did all that money go?"

So today, I decided to take a look and share that with everyone. Hopefully this helps clear up some of the questions people have surrounding it.

I jumped into this a bit a couple of weeks ago. But will go a bit deeper here and show recent expenses as well.

First, some history.

Gas taxes have been around in Florida since at least the 1940s. In 1943, Florida voters approved the Constitutional Fuel Tax (2 cents per gallon). Since that time, Florida has added other gas taxes it collects as well as gas taxes the county can collect. The Federal Government of course gets its share as well.

Gas taxes are broken down as follows:

Federal Fuel Tax - $18.4 cents per gallon.

Florida Fuel Taxes - 30.4 cents per gallon

Citrus County Fuel Taxes - 12 cents per gallon

So 60.8 cents per gallon go to federal, state and local taxes.

The state allows local governments to collect up to 12 cents per gallon via various taxes.

- First Local Option allows counties to implement a sales tax for up to 6 cents per gallon.

- Ninth-Cent Fuel tax is one penny. Its called Ninth Cent because gas taxes were 8 cents per gallon back in 1972 when the state added this option.

- Second Local Option: allows counties to collect up to 5 cents per gallon. This was approved in 2005. It is NOT charged on diesel sales.

Citrus implements the maximum amount of gas taxes possible.

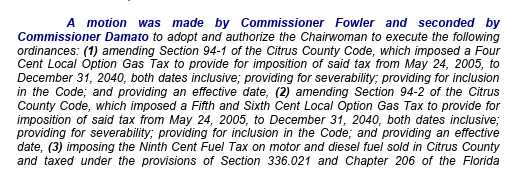

One myth I would like to clear up. Voters did not vote for any fuel taxes in Citrus County that I can find. They do not appear on the ballot. They were all implemented by ordinance by the County Commission, which is allowed by law.

The 2nd local option and the ninth-cent was approved on May 24, 2005 via a 4-1 vote (Bartell, Damato, Fowler and Phillips voted yes, Valentino voted no). It went into effect on January 1, 2006.

This motion also amended the previous ordinances on gas taxes and future motions changed them a bit as well, mostly for expiration dates. They all expire in 2034 now.

Fun fact about this. Back in 2005, they were facing the same problems we are facing today. They were facing a mountain of unfunded projects and no money to get them done. The estimated road needs for the next 5 years (through 2010), were close to $143 million. The total amount of the shortage over 25 years was $405 million.

They too were experiencing a local funding deficits with transportation impact fees that were too low.... Sound familiar?

It is amazing how history repeats itself, but we never seem to learn from it.

Fun fact #2.. They were also talking about the local option sales tax of 1%. This same meeting they discussed how it would work with the fuel taxes. They ultimately decided against pursuing the sales tax because they were increasing the fuel tax and felt that it would fail... although they did mention if the sales tax were successful, they would remove the fuel taxes (or a portion).

20 years ago... same discussions.

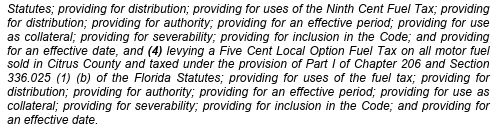

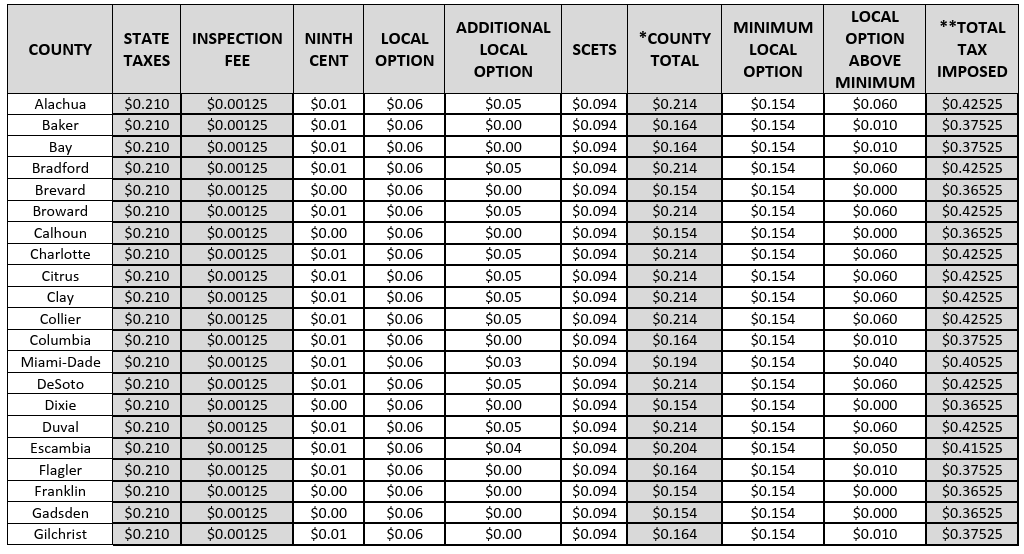

Now, to clear up something. There is a list of counties that implement fuel taxes. You can see that list below.

I hear all the time that gas is cheaper in Marion County than it is in Citrus.. and that may be true... But it is NOT because of county taxes. Marion collects the same taxes that Citrus collects on the state and local level (42.525 cents per gallon). Hernando collects the same. Levy is one penny cheaper. Sumter is 5 cents cheaper.

Fuel costs vary on factors other than local tax decisions. So if it is cheaper in Marion, there are other factors not related to taxes.

Back on track.

The spending of gas tax revenue is outlined in Chapter 94 of the county ordinances. Section 1 and 2 cover the first option fuel tax (4 cents and 2 cents respectively). Section 3 covers the Ninth-Cent fuel tax. Section 4 covers the 2nd local option fuel tax (5 cents). You can view the specifics here.

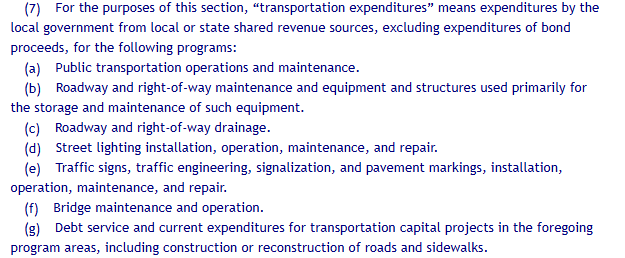

In short, the money can ONLY be used for transportation related projects as outlined in Florida Statute 336.025(7)

When people in the community start saying that the gas tax money is being used for other purposes and not for roads, I just shake my head. It simply cannot be used for other purposes. It can ONLY be used for the purposes stated above.

Now yes, some of those purposes are broad. For instance, it does not state specifically that the money can be used for mowing rights of ways on the roadways, but that is considered "maintenance" and an allowable use of those funds. You might be able to make an argument that funds that would have been spent on roads were moved to other things after the fuel tax went into effect, but that would have been at the beginning. Today, the budget is created with the fuel tax existing, so no money is being moved because of the fuel tax.

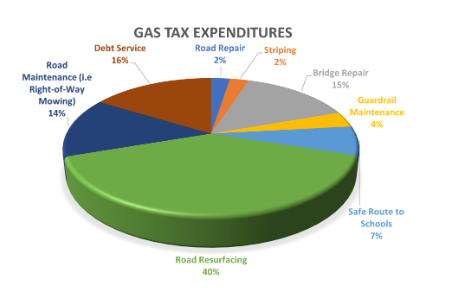

Here is the chart the county created to show how the funds are distributed and spent.

As you can see, the biggest piece of the pie is road resurfacing. But the majority is spent on other things aside from road resurfacing.

One thing I will disagree with the county on. On its gas tax website, the county claims that the 2nd option cannot be used for resurfacing. I do not believe that to be true. Reading the state statute and the ordinance suggests resurfacing is a valid use. However, the county tied that money to a bond, so it cannot be used until the bond is paid off. Those bonds being the 486 and 491 expansion projects.

Ok got it.. So how is the money used? Let's look at the budget.

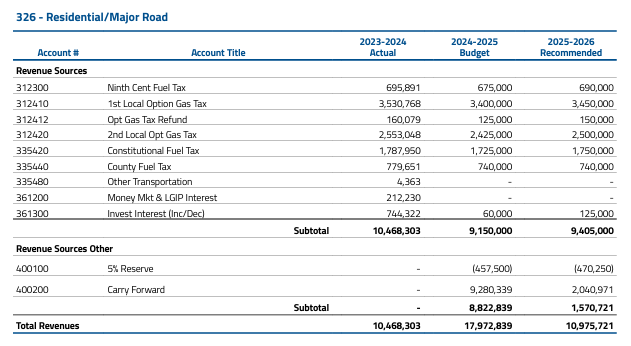

First, the revenues

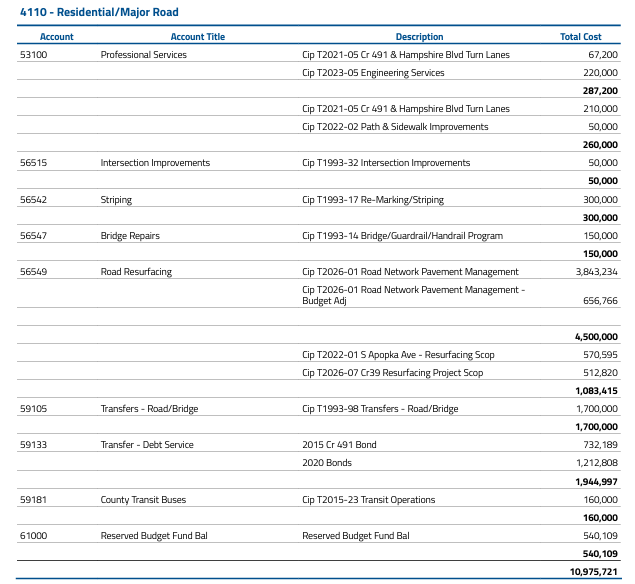

As you can see, gas taxes are supposed to bring in $9,405,000 in 2025-2026. There is a carry forward amount of $2,040,971, which is money not spent the previous year. Subtract the reserves and you are left with $10,975,721.

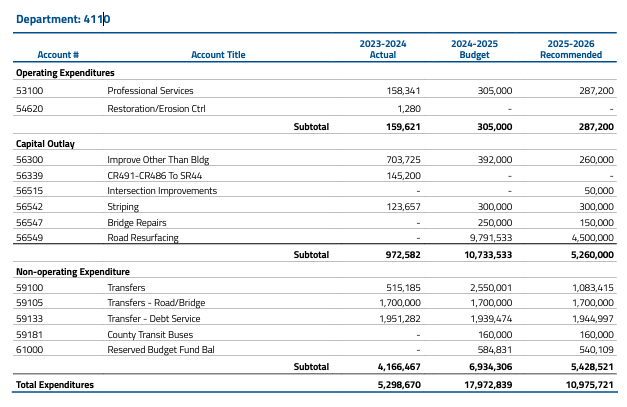

Here are the expenses.

Pretty self explanatory. You can see $4.5 million for road resurfacing for this upcoming year. Our consultants estimate it takes $40m a year to maintain the roads we have. Even with an overall road budget of just over $16m, we are well short. Gas taxes alone will not maintain our roads.

So what are those things like Professional Services, Transfers, etc?

The 53100 account "Professional Services" is the work being done on 491 and Hampshire Intersection to prepare it for a light.

You will see in 56549 that we are using $1,083,415 for SCOP projects. These are funds needed to match state grants to help resurface collector roads. South Apopka and CR39 are listed here for 2025-2026.

59133 Transfer Debt Service is the 486/491 bonds. We are paying $1,944,997 towards those loans this year.

But you will notice the letters "CIP" next to each of those expenditures. The county ordinance requires that the fuel tax money goes ONLY towards items in the county 5 year CIP (Capital Improvement Projects) and only those related to transportation and roads.

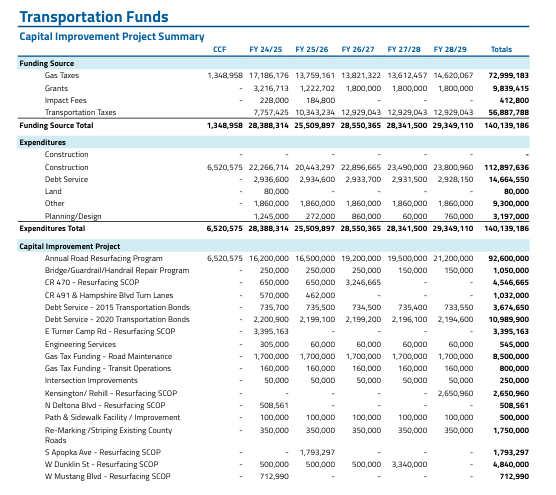

Here you can view the projects in the 5 year CIP. There are roughly 20 pages of transportation projects that fuel taxes can be used towards.

Here is a sample of what that looks like

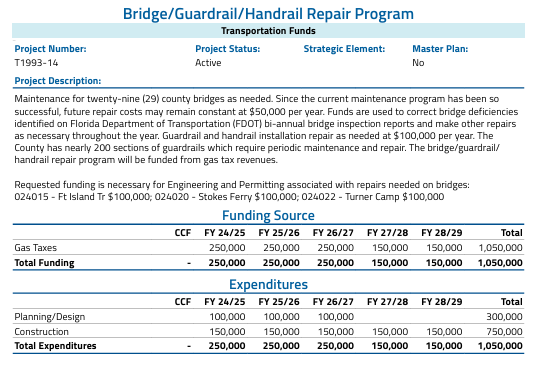

And if we look at an individual section like Bridge/Guardrail Repair

So you can see specifically that the gas taxes are going towards things they are allowed to go towards and not going to some pet project of a commissioner.... unless a commissioner is drooling over guardrails or pavement striping.

So the point of all of that is to show that gas tax money is going to what it is supposed to go to. Based on the $40m a year projected expense to maintain what we have, I think everyone agrees we are well short of that... but its not the fault of the county not using gas taxes properly. They are being used as intended and according to the ordinances.