Dispelling Some Myths

I wanted to address some things I have been hearing regarding the BOCC and taxes. With the conversation about the sales tax ramping up (will be on the agenda for a full discussion on October 7th), it is important for us to discuss how taxes are used.

This will not be sales tax specific. The Chamber has a website they put together with information specific to the sales tax. Also, their survey is there if you want to participate. Here is the website.

Let us first address how tax money is used. With all the talk about DOGE on the Federal and State levels, people here want to see it come to Citrus and audit the county for wasteful spending. The desire to find millions and millions of dollars in waste to provide relief for taxpayers is sky high.

And I get it.. Inflation, economy, unemployment... and so on are all factoring into everyday life for many in Citrus County. They feel increasing taxes is a burden and want the state to come to the rescue.

Let me say this to start. Even if the state comes in and says they found $20m or whatever in wasteful spending (just throwing out a number), the state cannot force the county to change the budget. Sure, they can put pressure on the county to make changes, but cannot force any changes to be made.

That said, I am certainly no accountant, but in my research to find savings, I am not finding much. Yes, you have things like consultants for the Comp Plan at $560k that could be removed. You have line items in individual departments that could be removed, as they did with the library, but I am not seeing tens of millions of dollars in waste. Remember, one mil of property tax equals roughly $15m in county revenue. We shall see. The County has submitted the requested documents to the state back in August.

Fees related to staffing is one of the biggest expenses in the county. This includes things like FRS contributions, insurance and so on. There are people working on this far smarter than I am, but I question why we cannot combine some of those things with others in the county.

For instance, the county operates its own health clinic for the employees. The sheriff's office also operates one as does the School Board. Is it possible to get some savings for all 3 entities if there was a shared facility that each shares the cost to operate? Can the same thing be done for insurance rates? Maybe it has been talked about and I missed it. Just a thought.

But I digress.

For those wondering, the county is audited by a 3rd party every single year. You can read the reports yourself and see where every single tax dollar that was collected was spent. No, it doesn't look for wasteful spending. It just looks for money and to ensure it was spent as it was budgeted to be spent. The county has passed every single year.

So no, no one is pocketing your tax dollars.

Here are audit reports by the Clerk's office. This covers things like boat ramps, Fuel Card usage, Citrus County Community Charitable Foundation, and so on.

Here are the last 5 years of Comprehensive Financial Reports

So if you care to see where money is going, there it is.

Gas tax. Man, what a big one and one full of questions.

First Facts... Citrus County has a webpage dedicated to the sales tax. You can view it here. It has a lot of good information.

Basics.. 60.8 cents per gallon is collected in Citrus County. It is broken up as follows:

- Federal Fuel Tax: 18.4 cents per gallon

- The state collects 17 cents per gallon

- State Comprehensive Enhanced System collects 9.4 cents per gallon to fund projects in the state's seven transportation districts.

- The Constitutional Fuel tax is 2 cents per gallon to fund county projects (state collected)

- County Fuel tax of 1 cent per gallon

- Municipal Fuel Tax of 1 cent per gallon

A portion of the 3 cents collected from the Constitutional Fuel Tax and County Fuel tax are allotted for Citrus county based on state formula

Then

- Citrus Collects 12 cents per gallon, the most allowed under state law via Local Option Fuel Taxes (Ninth cent fuel tax, First local option sales tax of 6 cents, Second local option sales tax of 5 cents as approved by voters in 2006). The county splits these with the cities.

In FY 2024, the gas tax brought in $8,840,000 in revenue

So where does that money go? The county has a good web page for this also. You can view it here.

In short, the money can only be used for certain things. All of the money cannot be used for resurfacing. That is the biggest misconception I have seen...

"We are already paying for gas tax, why isn't that fixing our roads".

Because it can't all be used for that.

The first local option fuel tax (6 cents per gallon) is collected for transportation expenditures. This includes maintenance, street lighting, signals, etc. The County keeps 90.95% and Cities split the remaining 9.05%.

The 9th cent fuel tax (1 cent per gallon) is collected for similar purposes. It is not shared with cities.

Second local option fuel tax (5 cents per gallon) started in 2006 and ends in 2034. This is also shared on the 90.95%/9.05% split with the cities. The big differences with this is that it needs to meet a capital improvement element. It can go towards resurfacing, but the county opted to use the money for the 486 and 491 projects. All of this taxed is reserved to pay off the debt service of these projects.

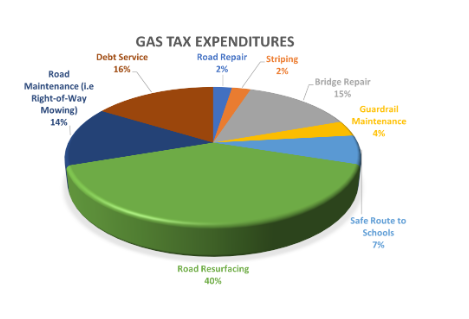

Here is a good chart from the county to show how all these taxes are used.

As you can see, road resurfacing takes up a bulk of the funds collected from these gas taxes.

The problem with the gas tax is that the funds do not increase with inflation. They are based on the total number of gallons sold in the county and that number is actually going down as cars are more fuel efficient or people turn to EVs, that do not pay a gas tax.

So less funds are being collected and with inflation causing costs to go up, that leads to a shortfall of funds for resurfacing. We cannot pave the same number of miles as the previous year with the same amount of money (or less).

That is where the sales tax comes into play and we will jump into that later this week.